Amanda Khatri

Editorial Manager

The modern risk landscape is as dynamic and challenging for banks as any point in history.

Institutions face a constant barrage of cyber threats, an unprecedented flow of regulatory updates, and an array of risks stemming from the ubiquity of advancing technology.

Whilst new tools have emerged to better serve customers, the growing reliance on technology has become a double-edged sword; efficiency gains and improved user experiences are countered by data security vulnerabilities, new avenues for financial crime, and regulatory uncertainty.

As a result of these changes, tens of millions of regulatory issuances have been published over the last decade which impact the financial services sector.

Onerous regulations related to capital requirements, market abuse and non-financial misconduct, financial crime and data protection have poured forth, increasing in volume and complexity.

Previously, businesses invested significantly in compliance tools to address historical issues, enhance policies, patch up legacy software, and attempt to keep pace with rising data management requirements.

However, many firms have found that manual regulatory change management processes are sinking under a rising tide of regulatory demands.

Within this environment, Automated Regulatory Intelligence has emerged as a beacon of hope.

The evolution of regulatory change management

In the immediate post-2008 crisis period, compliance budgets soared as banks sought to avoid a repeat of the problems which led to the crises.

Regulators began to issue new directives in enormous tomes, and compliance teams grew, fuelled by a need to ensure as many policies and control changes were handled by human eyes as possible.

Such has been the scale, complexity and pace of regulatory change, we have reached an epoch where compliance can no longer be assured with manual supervision alone.

Present era compliance executives recognise that expanding teams or outsourcing key tasks related to regulatory change management isn’t the answer; a truly robust defence against modern threats requires a synergy of human intelligence and machine learning tools.

The emergence of Automated Regulatory Intelligence

CUBE was founded in the wake of the 2008 financial crisis to transform compliance through machine learning and automation, and to help banks meet their regulatory obligations during this period of great upheaval.

Our technologies have not just evolved with the times but have pushed the boundaries of RegTech and redefined what is possible over and over again.

We have developed a leading suite of solutions, underpinned by Automated Regulatory Intelligence (ARI), which has transformed the compliance operations of some of the world’s largest and most complex financial institutions.

Household names including Citi, Deutsche Bank, Barclays, Danske Bank, and many more leverage our golden source of regulatory data to stay compliant and meet their obligations.

Machine understanding and regulatory language

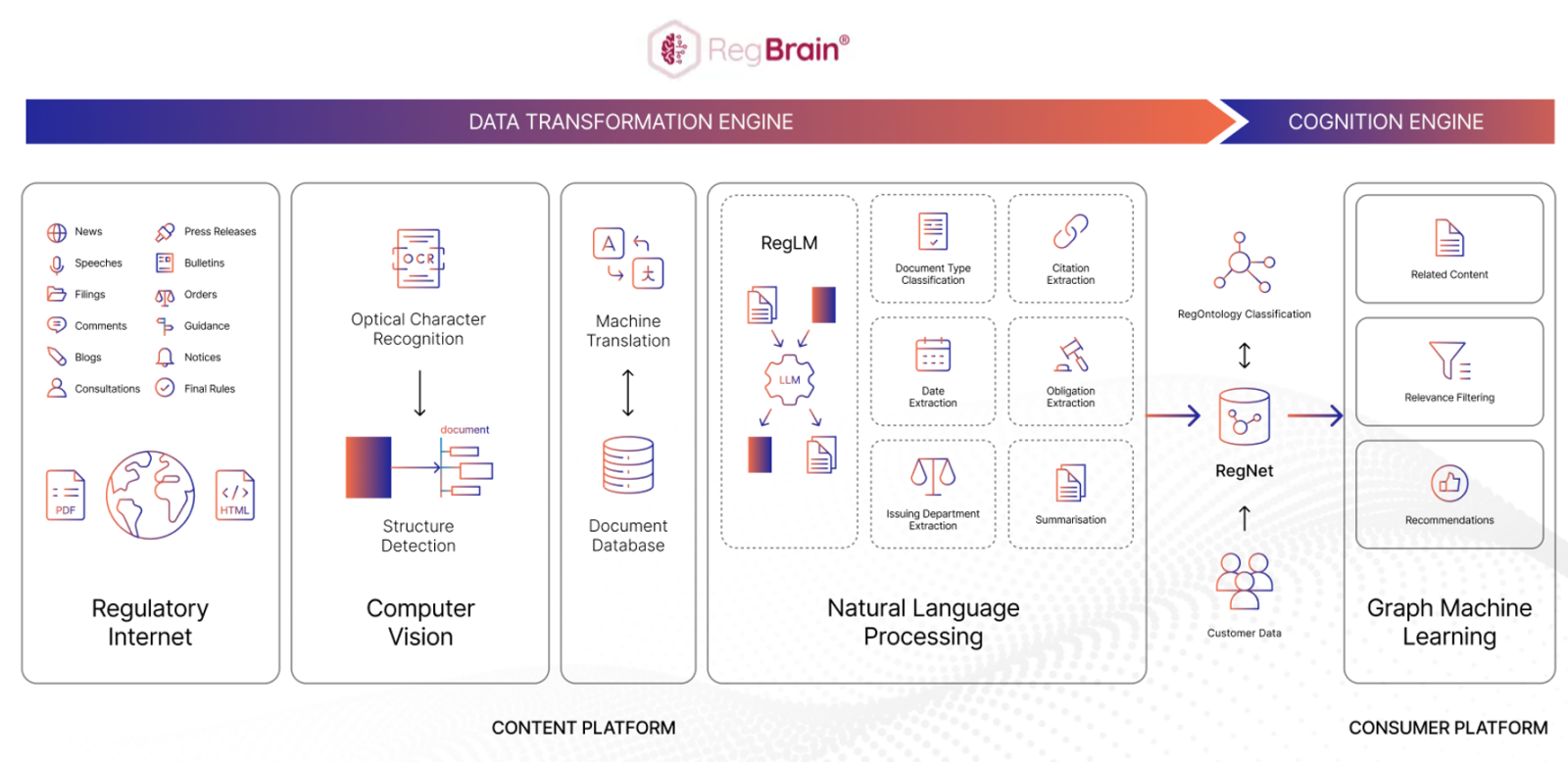

CUBE’s ARI deploys cutting-edge Natural Language Processing models to gain a deep understanding of syntax and legal vocabulary, providing banks with translated, enriched and user-specific actionable information only.

The machines identify key points in regulatory content, ensuring busy compliance teams are notified and presented with only essential information, saving time and resources.

Computer vision models collect and structure regulatory data from every single jurisdiction, in any language, to ensure our clients benefit from up-to-date regulatory inventories. CUBE’s intelligent tools also allow for fully automated workflows to be created, based on previous actions.

The architecture of the product and serverless deployment in the cloud is built specifically to manage the volume, variety, and velocity of modern regulatory issuances.

ARI delivers actionable insights into changing regulatory trends, suggests other relevant topics that may of interest, and help teams prioritise the right resources to tackle the regulation effectively.

This proactive approach ensures compliance with evolving regulations and enables businesses to adapt swiftly to regulatory changes, positioning them for success however uncertain the regulatory landscape.

The birth of RegBrain

The new era of compliance will be marked with advances such as our intuitive RegBrain solution. It allows banks to apply AI models directly to their own content, ensuring much faster release and feedback cycles.

RegBrain equips compliance teams with the power to access revolutionary features such as structural detection, classification, entity extraction, summarisation, and recommendations.

“As CUBE embarks upon a new era, we have reached the point where we have gone from machine reading of regulations to the early stages of machine understanding and the next phase will be machine enforcing,” said Dr Yin Lu, Head of Product and AI at CUBE.

“Compliance is a competitive advantage, not a cost centre. We have to shift this frame of thinking. And the advantage is provided by AI (with human experts in the loop, of course). Because of RegTech, the role of the compliance manager is fundamentally evolving.”

CUBE’s purpose-built AI engine (RegAI) tracks every single regulation in every regulated country, territory, and state across the globe in every published language.

The future of compliance and Automated Regulatory Intelligence

There are two clear trends apparent in compliance today; the volume and velocity of regulation will continue to rise, and proactive compliance is the only way to manage such a level of change.

For banks, Automated Regulatory Intelligence is the key to meeting these challenges, delivering efficiencies at scale, and revolutionising the capabilities of the compliance function.

To learn more about Automated Regulatory Intelligence and how CUBE can ease your regulatory burden, contact us today.